HOW YOUR SMALL BUSINESS CAN THRIVE DURING INFLATION

03/15/2023

By: Melyssa Holik

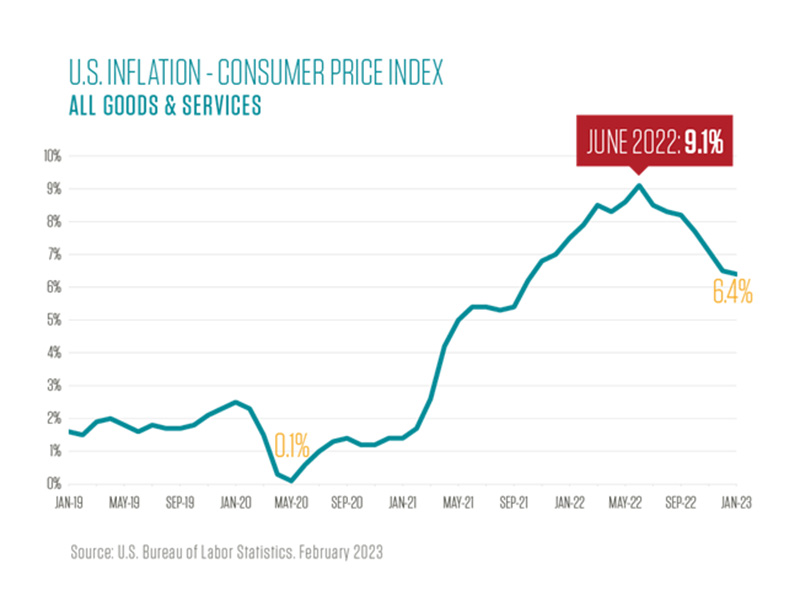

There is no doubt that the COVID-19 pandemic had a tremendous impact on our economy. Take a look at this chart that shows how much the cost of goods and services has increased from January 2019 to January 2023.

The U.S. GDP fell by 8.9% in the second quarter of 2020, that’s the largest single-quarter contraction in more than 70 years. And, inflation emerged as a challenge for the US as demand skewed toward goods and away from services.

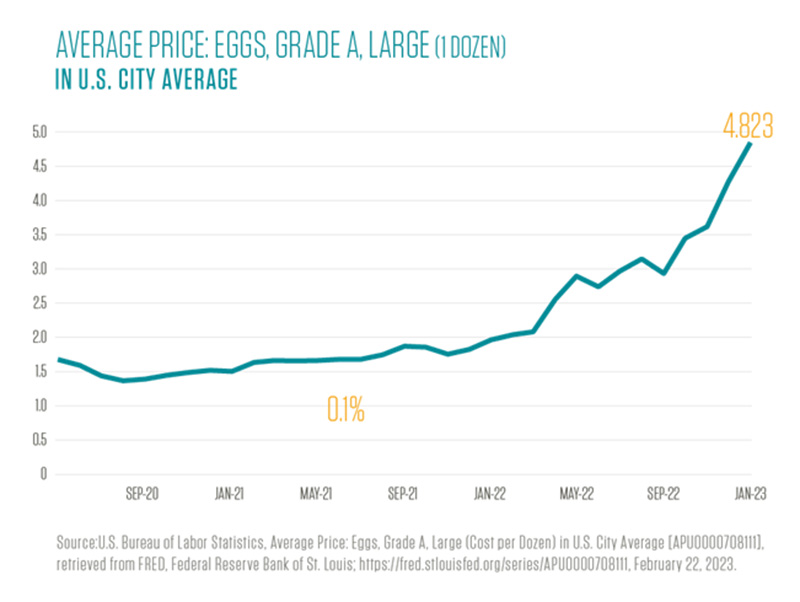

For example, the cost of eggs from before the pandemic through late last year had more than doubled. And today, a dozen large eggs may cost over $4.80, and a dozen organic eggs may be well over $8.99. That is more than a 300% increase from January 2020.

According to the most recent Federal Reserve press release, inflation remains elevated, reflecting supply and demand imbalances related to the pandemic, higher food and energy prices, and broader price pressures. With that said, the government has been under immense stress while weighing its options for sure.

And, as you may have heard, they opted to raise interest rates toward a possible recession, rather than lower interest rates toward inflation. In fact, they’ve opted for that same decision seven times so far. This has caused the prime rate to go from a low of 3.25% to 7.50% very quickly (between March 2022 and December 2022). The prime rate is the rate that most lenders use for pricing short-term loans, like credit cards, lines of credit, and auto loans.

If the government keeps deciding to raise interest rates, expect things to slow down. Unfortunately, we individuals don’t have any control over prime interest rates, but we do have control over how we manage our money.

Money management is one of the most foundational components of success in life and business and while it’s important, it does not have to be complex. It’s all about building sustainable money habits and systems.

So, let’s keep it simple as we talk about the two ways to put more money in your pocket. Yes, that’s right — there are only two ways.

- You can make more money.

- You can reduce your expenses.

Admittedly, the concept of putting more money in your pocket may be simple but it is not necessarily easy to accomplish. Making more money entails looking at your company’s products, services, and delivery model. Which items are your top sellers? Which items are your most profitable? Where do your best customers come from and where do they find out about you? As you can see, there is a lot of reflection that goes into this process; however, once you determine what is “important,” you can move forward to the next steps. You can use this concept in your personal life, as well.

Reducing your expenses is a similar process. You’ll want to evaluate things like how much it costs you to purchase or create your core products and services. What about labor? Are you doing everything yourself? Perhaps, your time spent on low-value activities can be outsourced to a virtual assistant, for example.

As a banking professional, I have worked with hundreds of businesses over the years and have heard many stories about great failures and successes.

Here are three commonalities among the most successful businesses that I have worked with:

- They have the ability to determine and focus on what is important — they hire qualified people for everything else.

- They have an incredible work ethic and they’re not afraid to get their hands dirty.

- They spend the majority of their time working on what yields the greatest results.

As a small business owner, you may be tempted to bootstrap and do it all yourself. I would encourage you to challenge that idea. Think of creative ways to partner with others and hire out any work that is not a high-value activity, or that you do not excel at.

Knowledge is Power

One of the best ways to set yourself apart from your competitors is your knowledge. We’ve all grown to learn different things based on our life experiences during our time on this earth. You can learn in many different ways but one of the best ways to learn is by talking to people. This may be your greatest source of information and referrals. Get involved in organizations related to your field and learn from one another. There are many people who know things you don’t know. Whether your business offers a product or a service, you will find great value in networking with others in your industry.

Staying in the loop about what is going on in your industry is also important. Find one or two sources of reliable, industry-specific information and read them daily. You need to become a subject matter expert in your field so make sure that you enjoy what you do because you’ll need to immerse yourself in it.

Know your numbers. Keep a current Income Statement and Balance Sheet for your company and a Personal Financial Statement for personal finances. Your company’s income statement will show income, expenses, and profit. Your balance sheet will show what your company owns and owes. This is like a report card; it helps you see how you are doing and identify areas where you may need to improve.

Qualifying for a Business Loan

Many new business owners want to borrow money as soon as they get started. Now, there’s nothing wrong with this if you need the money to purchase something that will put more money in your pocket; however, I’d encourage you to be prepared with funds of your own to contribute before opting for a loan right out of the gate. One of the best things you can do when you are getting started is to keep your expenses minimal while you slowly build your sales. While lenders are cheering for you to succeed, they need to feel comfortable about you paying them back. Having sales behind you and good credit history are two ways to get their buy-in.

Those first few years will be tough, but once you can demonstrate your ability to make money, pay your bills on time, and have some proof of concept, things will get much easier. Something I recommend doing in the early start-up stage is establishing a relationship with your local Small Business Development Center and get connected with lenders that specialize in lending to start-up businesses and businesses that operate in your industry. There are many resources available such as SBA’s LenderMatch tool that connects borrowers with lenders based on their needs and preferences.

Most lenders will ask you for your tax returns, financial statements, income verification, and bank statements. These are all things that you can and should have prepared in advance. I recommend using cloud-based services like Google Drive, Dropbox, iCloud, etc. to keep your documents organized and accessible from the palm of your hands.

Lastly (and again), know your numbers. You should have a general idea of what your credit, income, and net worth looks like so that you can openly talk about it with your banker. Having a good relationship with a financial partner will help ensure they are looking out for your best interest.

At State ECU, we want to see you succeed. Schedule a time to speak with our business department to see how we can help your business thrive.